Pera retirement chart

TIER 1 Members are eligible to retire from PERA when they meet the age and service credit requirement for the plan they participate in. By the numbers.

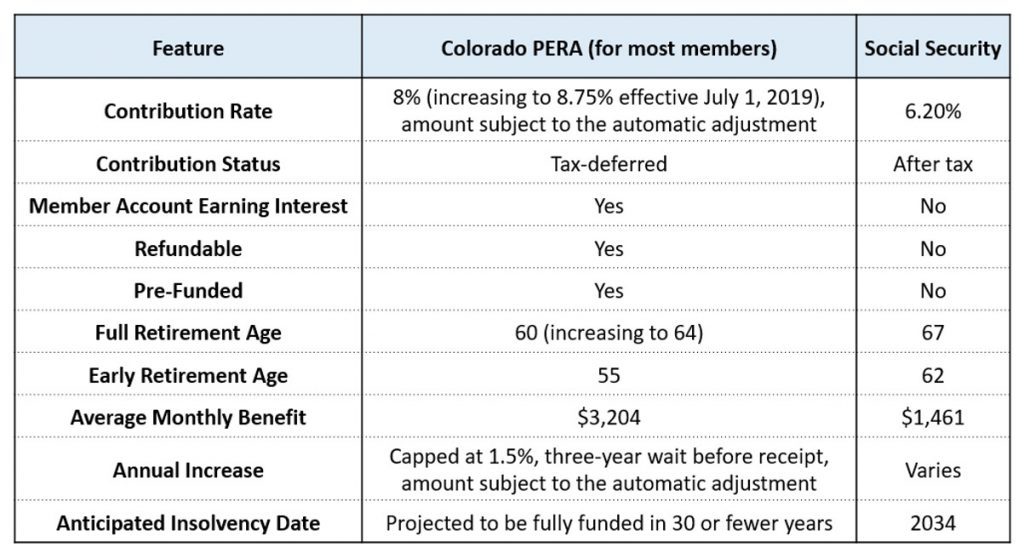

Pera And Social Security Pera On The Issues

PERA 1 PERA Benefit Structure Highest Average Salary Percentages for Retirement Benefit Option 1 Use this table if you began PERA membership on or before June 30 2005 had five.

. 15 Police Fire Plan. Product Provider An institutionentity which provides and sells PERA investment products. Provides a monthly benefit to you for your lifetime.

The second chart shows the percentage of final compensation you will receive. PERA benefit recipients will receive an annual Cost of Living Adjustment COLA in January 2022. The PERA member is age 55 and the former spouse is age 53.

Personal Equity Retirement Account PERA PERA is short for Personal Equity and Retirement Account. Your pension is a Defined Benefit Plan which means your monthly benefit will be determine by a formula and is payable for life. The Single-life pension is estimated at 2000 per month.

PERA is a tax-exempt retirement planning instrument for Filipinos. Your age and your service credit determine your retirement eligibility. The PRO permits an active member of.

When you die payments stop the first day of the month following your death. A PERA account is available to anyone who has a Tax Identification Number TIN and has legal capacity to. The first chart shows how the benefit factor increases for each quarter year of age.

1152020 Download the form below. The annual contribution for PERA members will increase to 11 next year from the current 105. When your age and your service credit intersect in a box on your appropriate highest average salary table you are.

The minimum age for a normal PERA retirement is 58 for the most recent hires in the School Division and 60 for the most recent hires in other divisions not including Troopers giving. Form of Payment B - 100 Joint Survivor Option. The calculation of the pension amount to be awarded to the.

Investment Manager Entity also regulated who makes the investment decisions. It refers to a voluntary retirement account established by and for the. On the benefits side the cost-of-living adjustment is.

25 Year Retirement Plans with a 20 Percent. Members of the General Plan will receive a 15 increase in their PERA retirement benefits effective Jan. General retirees receive 50 of the Social Security increase but not less.

The minimum age to draw a benefit is 55 for the. These percentages ensure that as of your effective date of retirement your reduced retirement benefit is the actuarial equivalent of your full service retirement benefit. PERA Contribution Chart Purpose This chart provides contribution rates for PERA retirement accounts.

The Phased Retirement Option PRO is a tool that allows employers to meet their workforce needs while employees transition into full retirement. These percentages ensure that as of your effective date of retirement your reduced retirement benefit is the actuarial equivalent of your full service retirement benefit.

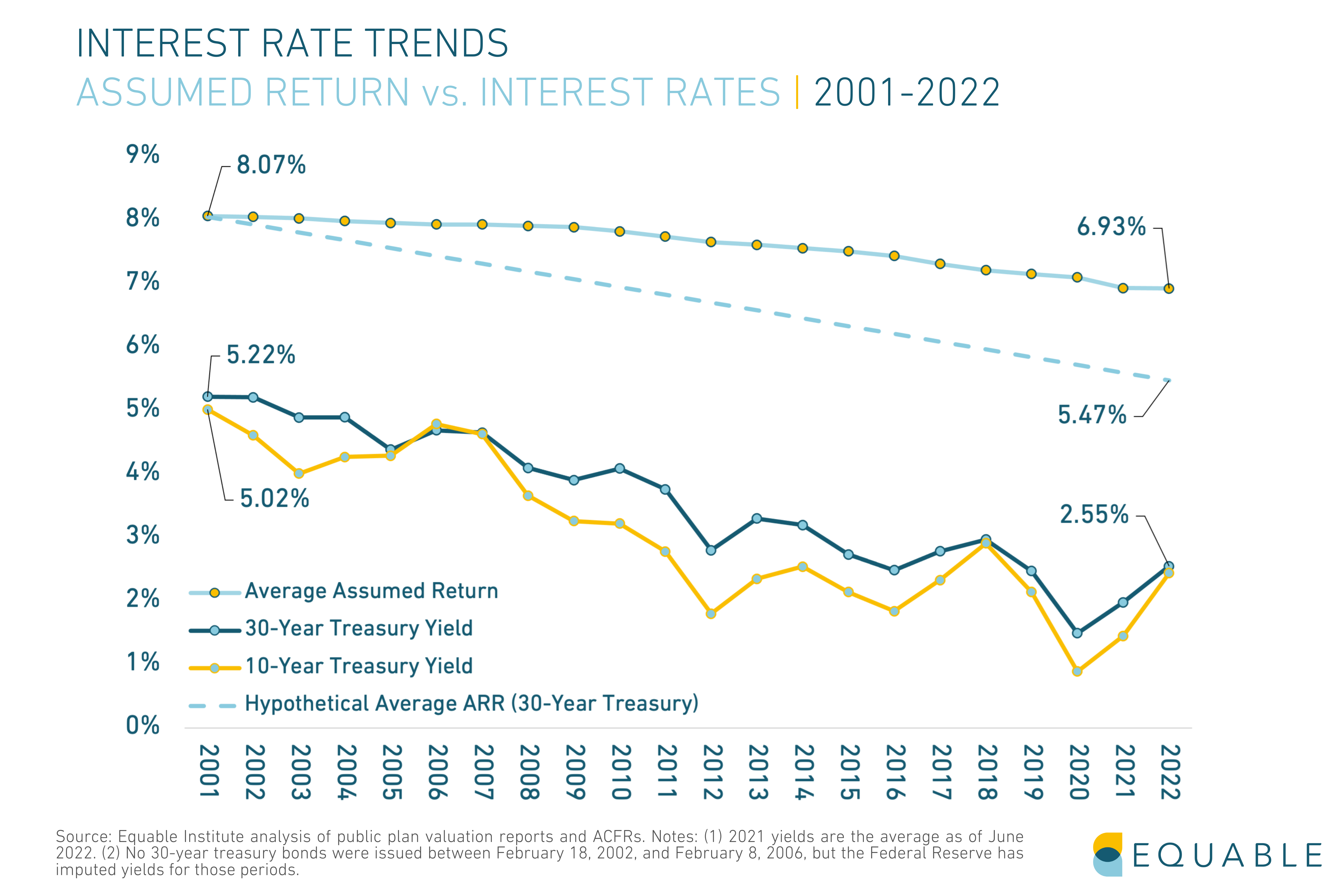

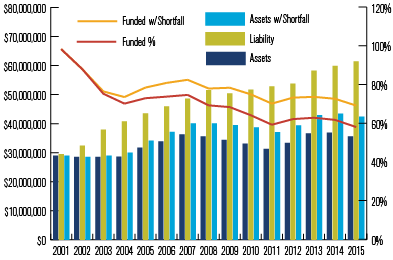

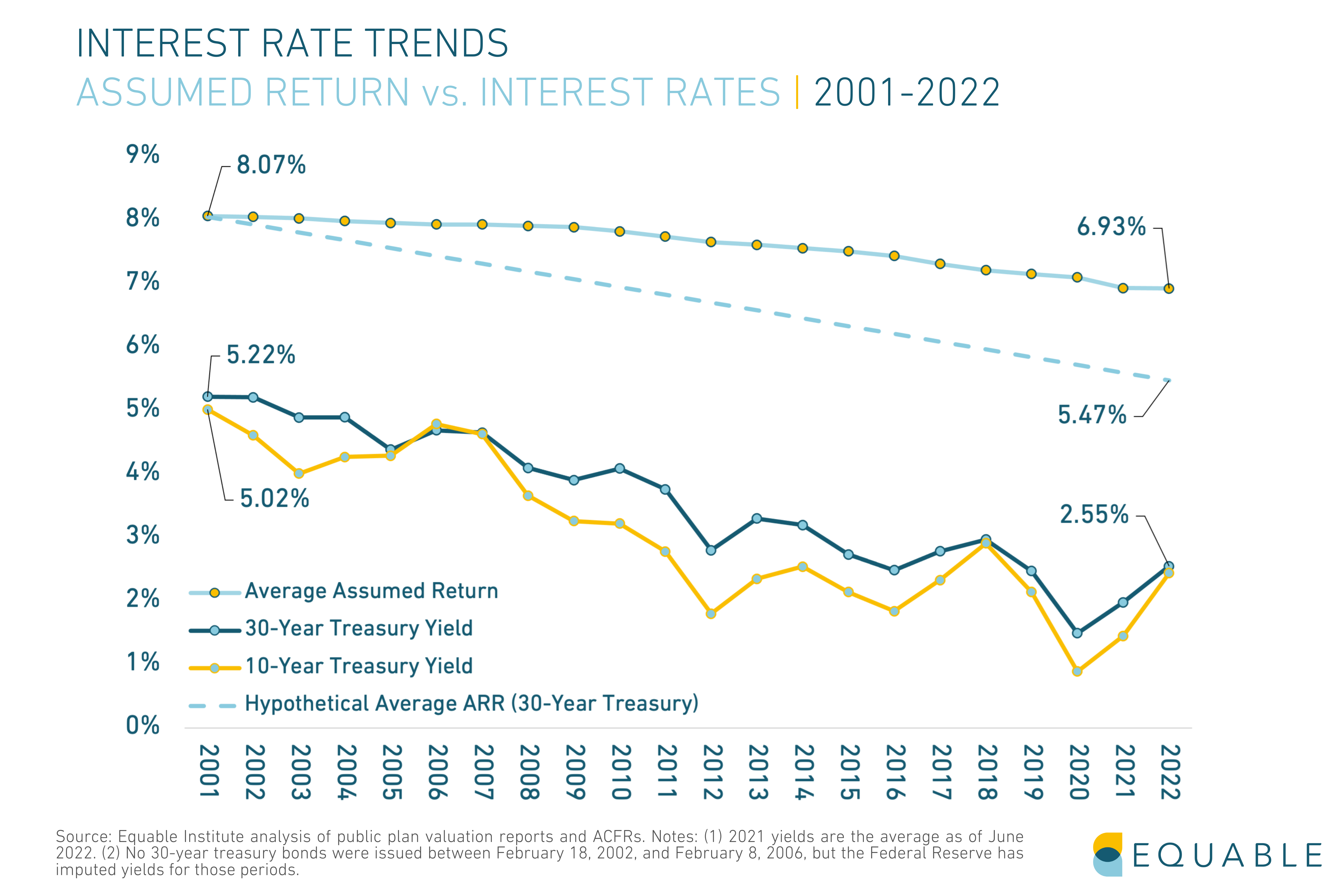

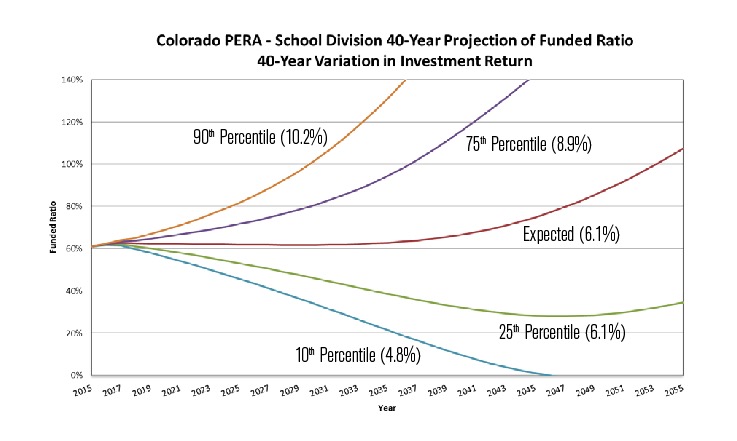

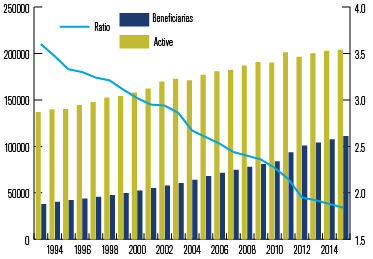

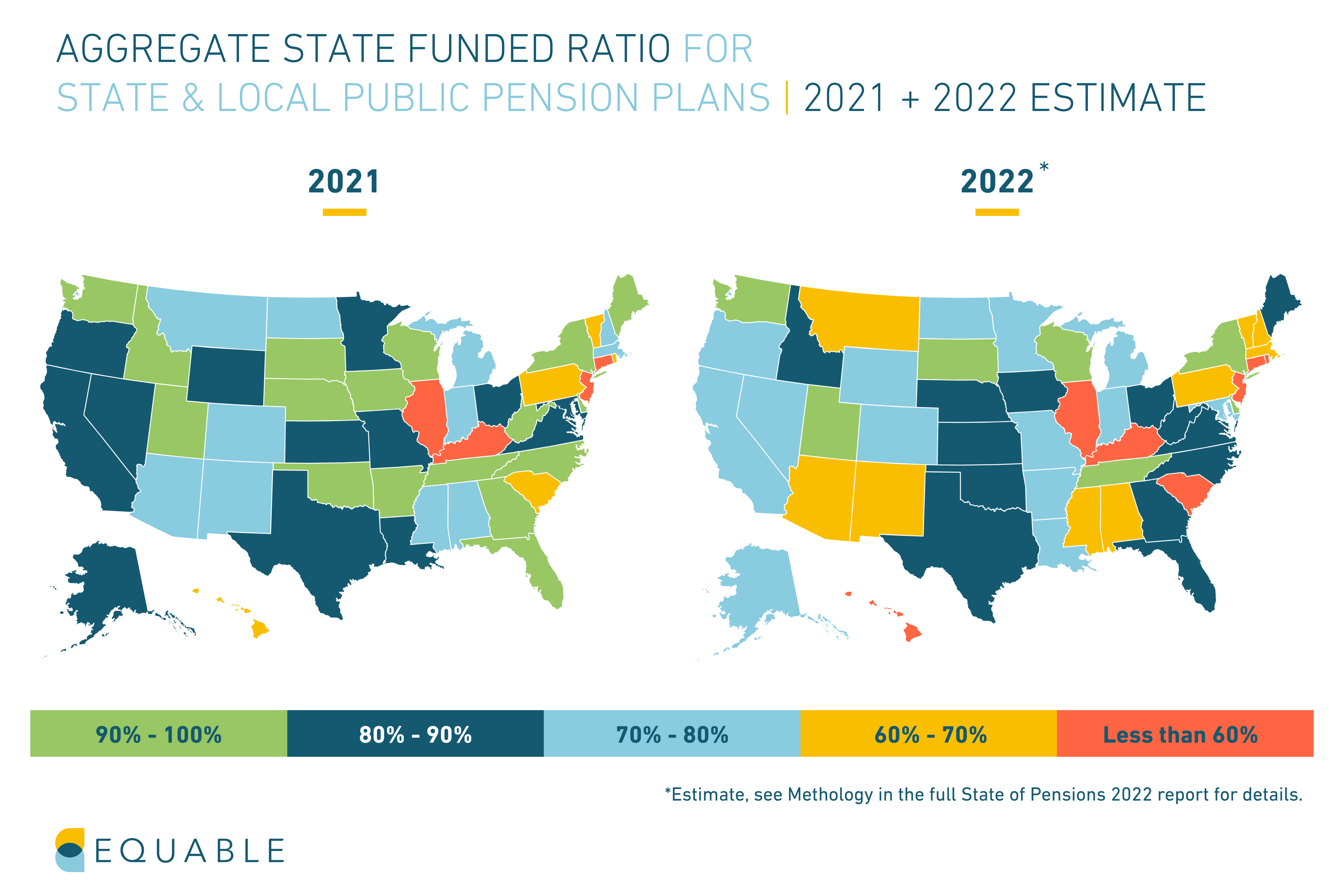

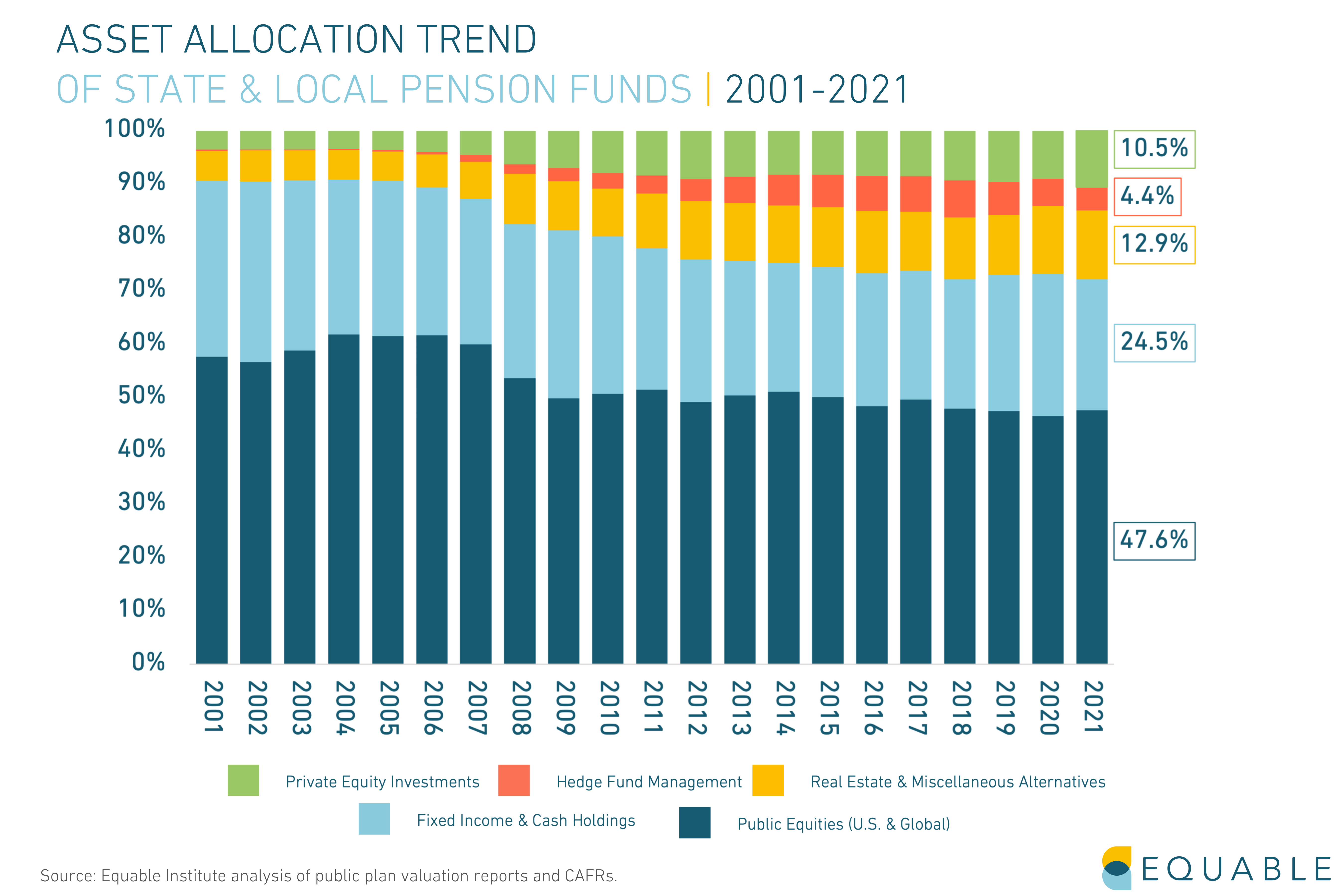

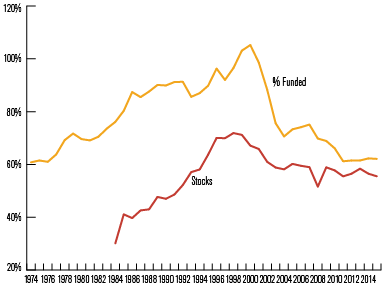

Pera S Problems In 2016 Independence Institute

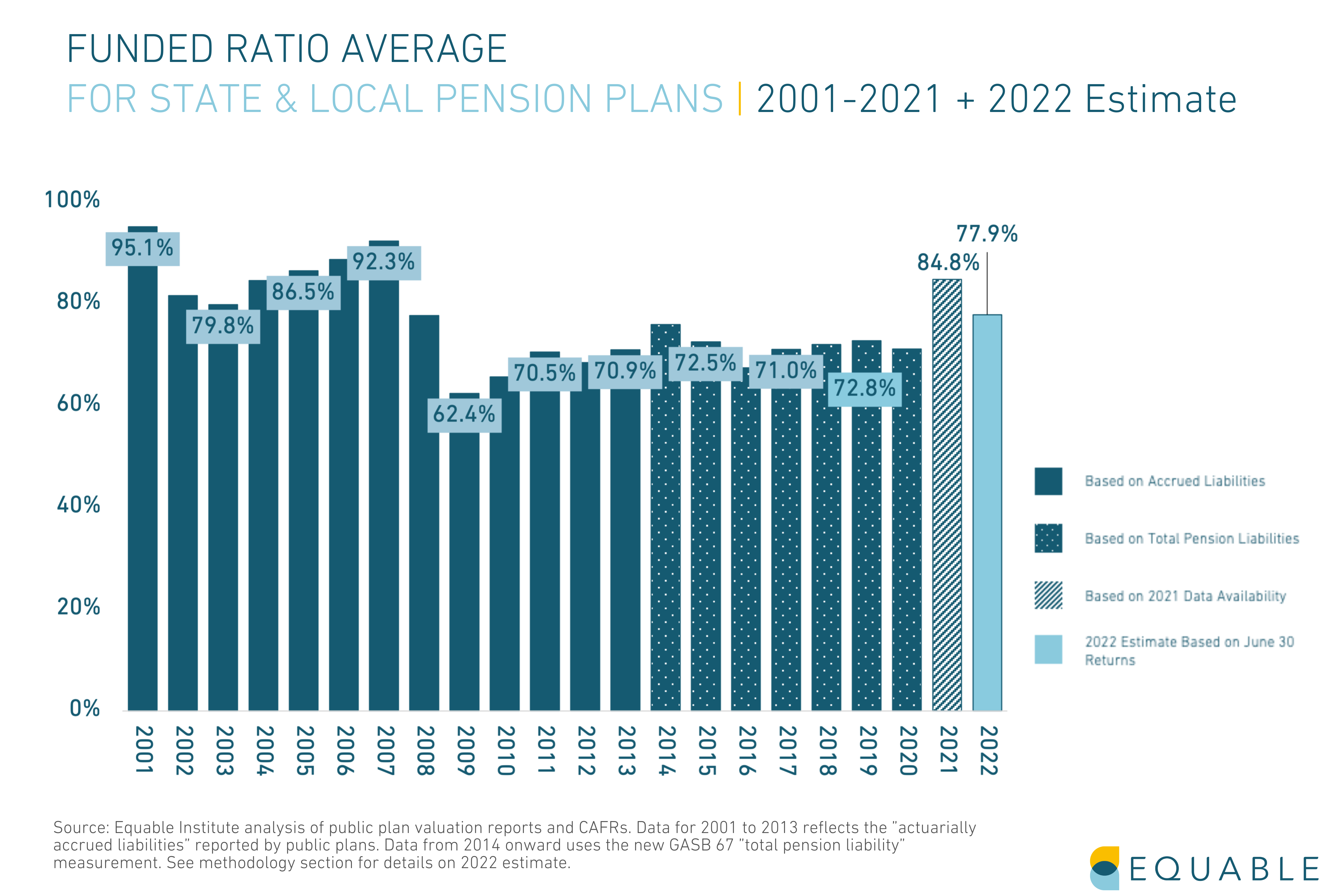

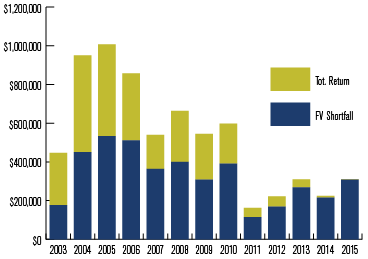

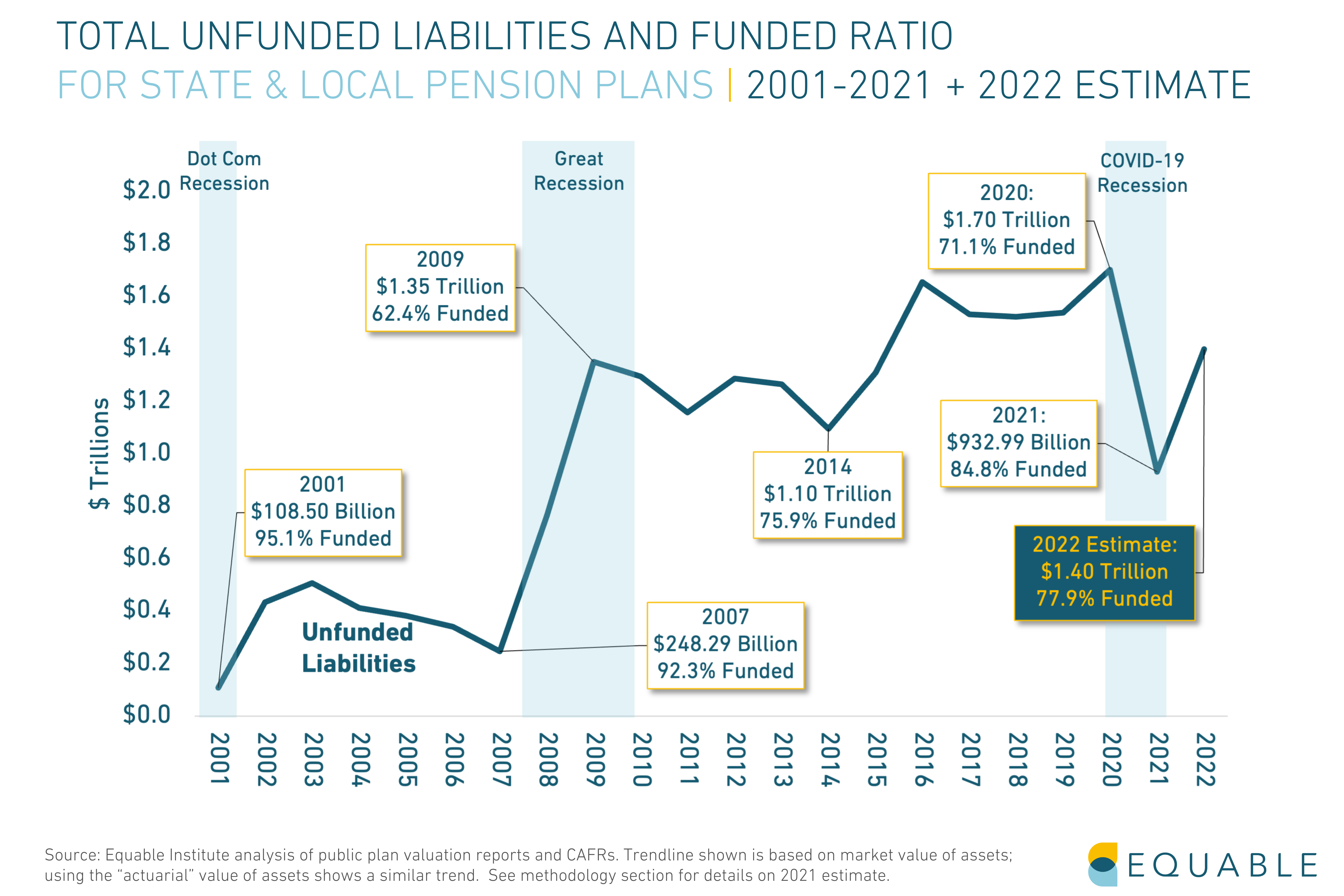

Pension Liability Payments Grab Big Share Of Limited State Revenue

Pera S Problems In 2016 Independence Institute

Pension Liability Payments Grab Big Share Of Limited State Revenue

Pera S Problems In 2016 Independence Institute

Pera S Problems In 2016 Independence Institute

2

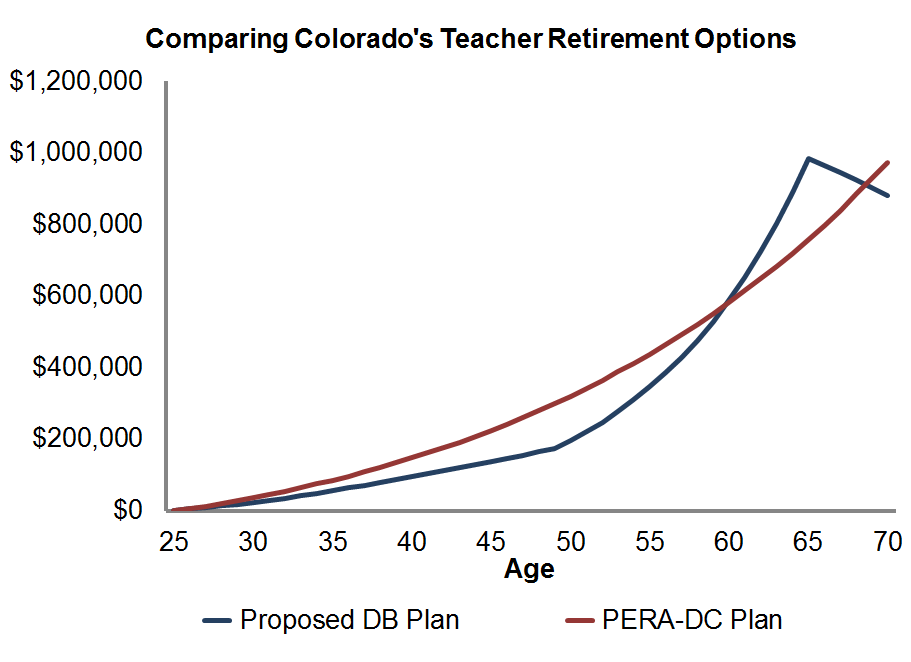

Colorado Teachers Deserve A Say Over Their Retirement Teacherpensions Org

2

Pera S Problems In 2016 Independence Institute

Pension Liability Payments Grab Big Share Of Limited State Revenue

Pension Liability Payments Grab Big Share Of Limited State Revenue

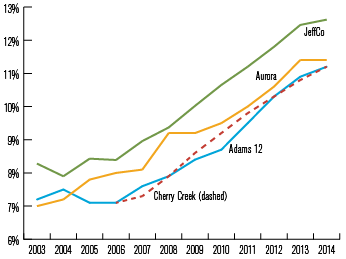

Pin On Support Jeffco Schools Infographics

Pension Liability Payments Grab Big Share Of Limited State Revenue

Th Q Pera Pension Calculator

Pera S Problems In 2016 Independence Institute

Pera S Problems In 2016 Independence Institute